Money Lover is an application for those who want to keep their finances under control. With its help, you can monitor your spending, create a budget and always be aware of how much savings you have. In addition, the application can record your debt obligations and regular payments, as well as remind you of the need to make the next payment.

2. Money Manager

This is very functional application. It allows you to control income, expenses, and also provides comprehensive statistics for any period of time that interests you. Among the most significant functions are the following: access to data from a computer, use of a double entry system for individual categories, management of credit and debit cards.

3. Zen money: cost accounting

“Zen Money” can independently record expenses, which eliminates the need to manually make each payment and purchase. To do this, you can connect to the application the import of transactions from Sberbank, Alfa Bank, Tinkoff Bank, Yandex.Money, Webmoney or QIWI.

In addition, the application can receive information about debiting money from incoming SMS from all the largest banks in Russia, Ukraine, and Belarus. With Zen Money, you can see the overall picture of your finances and understand how much money is free and how much you need to reserve to pay bills.

4. Bills Monitor

Each of us has to make a large number of mandatory payments every month. Rent, utilities, cable TV, internet, language courses, gym and much more. Missing any of these payments will cause you problems or deprive you of any benefits, so it is better to try not to forget about them.

With the Bills Monitor application, you will be absolutely sure that you paid all your bills on time, and also get an idea of how much money you have left over to live on.

5.Money Wallet

Some users may feel that Windows platforms Few high-quality applications have been written for maintaining personal accounts. However, it is not. A living example is Money Wallet, which unites all your accounts in one place, monitors your budget and promptly reminds you of scheduled payments.

You can keep accounts in the app various types(cash, bank account, credit card). It supports multi-currency with the ability to update the current exchange rate via the Internet, and also allows you to create weekly, monthly and annual budgets.

6. Goodbudget

Goodbudget is an app for taking control of your personal finances. Its main difference from other programs is that the user is asked to create a financial plan for the month. You enter how much you'd like to spend on entertainment, transportation, food, and other spending categories, and Goodbudget will track how well you're sticking to your goals.

7. Monefy

Monefy will help you organize a convenient system for tracking all your expenses. This application has an intuitive interface that allows you to instantly add new entries. If you have several devices or want to keep track of the expenses of the whole family, then the application has a synchronization system via Dropbox. In the same cloud service are stored backups data in case of any failure or loss of the smartphone.

8.Splittable

The Splittable app is designed specifically for people who rent an apartment together or share household costs with other family members. With its help, you can easily understand who pays more for utilities, how much money everyone spent on purchasing groceries and other general needs. Splittable will bring order to your overall expenses, which will help you avoid unnecessary disputes and resentments.

9. Expensify

Expensify's main task is to store and recognize cash receipts. You just need to take a photo of the bill in a cafe, bar, or store, so that the smart application itself will enter the amount presented on it into the desired expense category. An ideal tool for business trips, after which you need to submit a detailed report on the money spent to your company.

10. Moneygraph+

Moneygraph+ is a simple and clear way to track finances for entrepreneurs, copywriters, business people and representatives of other professions who have constantly changing sources and amounts of income.

The application allows you to create several accounts and make transfers between them, use built-in ones and create your own expense categories, customize and save reports, synchronize data between several devices via OneDrive.

What apps do you use to manage personal finances?

Where did all the salary go? Who is to blame for money slipping through our fingers? How to get your personal finances in order? If you, like me, are concerned about these issues, it’s time to become your own accountant.

No, we will not study balances and holdings; we do not need to master reversal entries and currency clearing. In today's review – 3 free programs For home accounting. All of them are intended for those who, like me, have absolutely no understanding of economics.

AceMoney Lite

– the “little brother” of a comprehensive personal finance management tool – the paid AceMoney application. Unlike full version, Lite only allows you to manage two accounts, but for many of us that's enough.

An account in IceMoney is not only a bank card and a savings book, but also a collection of cash belonging to a family or one person.

Application features

- Management of personal cash flows in currencies of 150 countries.

- Track currency exchange rates in real time.

- Budget distribution for various needs: the application contains more than a hundred different expense items.

- Tracking regular income and expenses (salaries, rent payments, loan payments, replenishing your phone balance, etc.).

- Calculating expenses for specific purposes over a certain period of time. A couple of clicks and you will find out how much you spend monthly on groceries, how much on gasoline, etc.

- Generating reports on accounts, categories and correspondents (recipients of payments from you and those from whom you receive them).

- Export reports to Excel formats and html.

- Receiving information about the status of a bank account directly from the bank.

- Tracking the value of stock shares - for those who.

- Calculation of savings, debts, mortgages.

- Control using hot keys.

- Flexible settings, enable, disable individual elements and much more.

The program has a Russian-language reference manual plus on the developer’s website.

How to use AceMoney Lite

Working with AceMoney Lite begins with creating an account. To do this, click the button of the same name on the top panel and click “ Add account" We will indicate its name, group (for example, bank deposit, cash or loan), number (if any), bank name, interest rate, currency and other data that you need.

Next, enter information about replenishments and: click on its name and select “ New transaction"(record about an incoming or outgoing transaction). In the window " Transaction» We note its type (income, expense, transfer), correspondent, category (what you spent on - select from the list or write manually), date, number, amount and comment.

While in the same section, you can download transactions directly from the bank’s server, if the latter provides such services. You can balance multiple transactions.

Recurring transactions (salaries and regular payments) are added to the program through the “ Schedule" Click on the button “ Add payment"and indicate the parameters - frequency, duration, type (income, expense, transfer), source, correspondent, category, amount, etc. Regular transactions will be included in the list of transactions automatically.

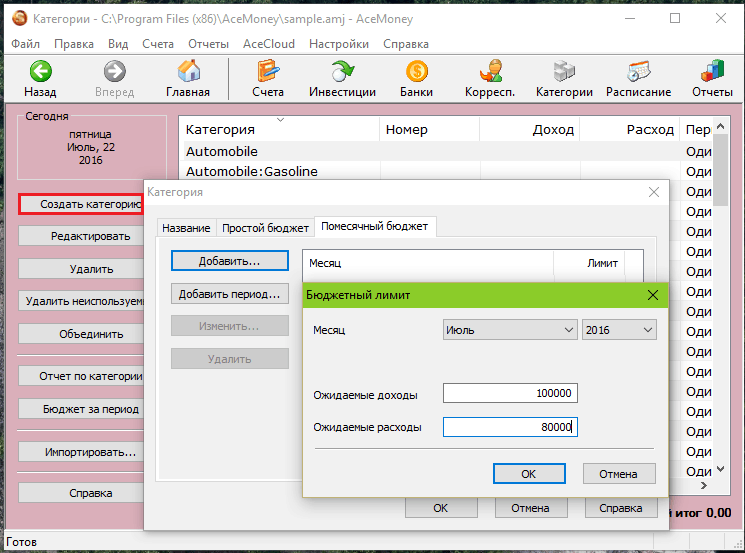

The distribution of finances for various needs (budget) is made in the section “ Categories" Here we can select several predefined income and expense items (refueling the car, spending on food, etc.) or add our own. When creating and editing a category, you can set a different budget period, indicate expected income and expenses, as well as a limit.

In general, AceMoney Lite copes with its tasks very well. Users note that thanks to the program they were able to reduce monthly expenses by 10-30% and finally understand where the money goes. It has only one drawback, more precisely, the current version - 4.36: writing categories in English.

AbilityCash

At first glance, the program seems incomprehensible and unfriendly - the windows are nondescript and half-empty, there are no explanations, no help (not written yet). But if you spend 15-20 minutes studying, a lot of its advantages will open up. Many of those who have mastered AbilityCash consider it more convenient than AceMoney, and generally one of the best free programs for home accounting.

Key features of AbilityCash

- Creation of invoices without restrictions on quantity and in different currencies.

- Tree structure of income and expense items (you can add as many subcategories as you need).

- Import and export data to xml formats and Excel.

- Download current exchange rates (optional).

- Drawing up and printing reports on exchange rates, fund balances and turnover dynamics.

- View transactions by income and expense items for a selected period of time.

- Support for Ukrainian and Lithuanian languages (selected during installation).

The following options are disabled by default:

- Tree structure and additional charts of accounts.

- Budget period in operations.

- Fields "Price", "Quantity" and "Time" in the list of transactions.

- Several comment fields that you can give your own name.

To activate any of this, go to the menu " File" and click " Data File Settings».

How to use

Using AbilityCash, like AceMoney, begins with creating accounts and indicating the current cash balances on them. To do this, open the first tab and press the “ Insert" In the window, enter the name of the account, select the currency and indicate the balance.

By default, AbilityCash has only one currency - Russian ruble. To install additional ones, press Ctrl+R and download the latest data from the website of the Central Bank of Russia. In the last window, select the currencies you want to display in the application.

To the section " Operations"(similar to AceMoney transactions) information about specific purchases, payments, receipts and transfers of money between accounts is entered.

To get summary data on the state of finances or exchange rates, open the tab " Reports».

AbilityCash – without a doubt decent tool accounting of personal funds. And it would be even better with context-sensitive help, which the developers don't seem to remember, and a more user-friendly interface. However, there is a short version on the official website. There is also a place where you can ask a question if something is unclear, or report a problem.

Economy

The “” program is perhaps intended for those who are completely unfamiliar with accounting science and for whom the concepts of “transaction” and “investment” evoke deep melancholy. There is no scientific terminology in it and everything is so simple and clear that both a child of 10-12 years old and a person of advanced age can use it. The only limitation is paid version– total monthly income is not more than 14,000 rubles.

Application features

- Creation of any number of accounts and accounts, including currency ones.

- Maintaining records in the currencies of several countries.

- Separate items of expenses, income and debts for each user.

- Reminder function for regular payments and overdue loan (debt) payments.

- Creation of reports on several categories: fund balances, income over a period of time, debts and loans, expenses of each user for a given time period, income minus expenses.

- Filtering data for viewing.

- Automatic backup.

- Built-in Russian-language help.

- Go from the main menu to the developer's website.

To quickly master the program, you can download a demo file immediately after installation. It contains an example of budgeting for a family of two people.

How to use

First, let's create a user and link all his accounts to the account:

Today we will look at useful programs for maintaining the family budget. Immediately after reading the review, you can download any application you like for free and use it for personal purposes.

Unfortunately, I was unable to find completely free programs for you. Each product has a trial period, after which access is blocked. Therefore, I advise you to do the following:

- Work with each of the listed applications in turn. If you use all the available time, it will take you several months;

- Choose one product you like and buy its license. Since the cost of all the described programs does not exceed 1,300 rubles, every family can make such a purchase.

P.S. I recommend paying attention to “”. Financial literacy is taught here. How to properly manage personal finances in order to save for a house, apartment, car. How to properly invest your accumulated money and increase your income. Allow yourself an annual vacation and travel around the world.

You can download the program Here. The free version is valid for 2 weeks. If after this period you do not buy license for 400 rubles, temporary access will be closed.

Let's list the main features.

- You can add categories and edit existing options.

- There are two calculators: one for regular calculations, and the second for working with credit amounts.

- There is a built-in task scheduler into which you can enter upcoming payments. Helps you not forget anything and pay your bills on time.

- There is a function responsible for creating a family budget plan. All data is structured and presented in Excel format.

- Each report can be displayed in the form of a chart or graph.

- The analyzed data can be combined into groups, intermediate values can be calculated, and the results can be viewed in different currencies.

- A diary is connected in which you can set reminders about the most important important events day.

Home Finance is an inexpensive and highly convenient program, which will take the user some time to master. To make things easier for yourself, watch this video.

Home accounting

to install trial version, click Here. To purchase a paid product for one PC you will need 990 rubles. You can view all program options and make a purchase Here.

Main features.

- In one program you can calculate the budget of several family members.

- IN working panel There are no unnecessary functions, so it won’t take much time to master all the functionality.

- In addition to the income and expense part, with this program you can control all loan payments.

- IN working window You can import electronic bank statements.

- Function Reserve copy securely stores all entered information.

“Home Accounting” is one of the best programs that allows you to gain control over your personal finances.

Home Economics

Trial profession available Here. To purchase the paid version you will need 590 rubles. You can place an order at this website.

Main features.

- Distribution of income and expenses by category.

- Planning of all financial actions.

- Availability of a savings calculator that can predict the level of inflation and select the best investment deposit.

- View exchange rates.

- Calculation and selection of the optimal loan offer.

In my subjective opinion, “Home Economics” best program, which has everything you need to account for personal funds.

MoneyTracker

Main features.

- Accounting can be carried out by an unlimited number of users.

- Login to the program is performed using a personal password.

- An unlimited number of currencies are available for calculating and maintaining home accounting.

- With the help of a convenient search and color highlights, the desired financial transaction can be quickly found and tracked.

- Drawing up a list of necessary purchases and planned payments.

"MoneyTracker" - good program, which, after a short adaptation process, becomes an indispensable home assistant.

AceMoney

You will find a trial version in Russian Here. You can buy the program for 1300 rubles at this website.

Main features.

- All accounts are divided according to target criteria and can be supplemented and edited.

- There are 100 built-in expense categories, through which you can track all outgoing financial flows.

- A section has been created for working with savings and investments.

- Every month, the user receives detailed reports that indicate where each part of the budget was spent.

- Backup and password system will reliably protect all created reports.

"AceMoney" is simple, clear and required program, which will be especially useful for users just starting to get acquainted with the system of organizing a family budget.

Conclusion

Friends, we have completed our review of popular programs that will help you manage your personal finances. If you download them today on your Android or PC, I guarantee that next month it will be much easier to manage your home budget.

- “How to keep a family budget in a notebook - an example with tables of income and expenses.”

- “How to properly manage, plan and save your family budget - 10 useful tips.”

- “7 books on personal finance management whose authors influenced millions of lives of their readers.”

Last update: 17-02-2019

The purpose of all home accounting programs– simplify the accounting of income and expenses.

The user of the program can set more specific goals: tracking savings, monitoring timely payment of loan payments, etc.

Some programs are specifically designed to help the user set and achieve financial goals.

When choosing a personal finance accounting program, you need to pay attention to two main criteria:

- functionality;

- program manufacturer.

Home accounting software features include:

- creating reports on income and expenses, on the dynamics of the balance of funds, accounting for different accounts;

- loan and deposit calculator;

- budget planning, calendar of future expenses.

The following options will be useful:

- fast transaction entry;

- recognition of SMS from the bank;

- multiplayer mode;

- synchronization of mobile and computer versions.

Among the software producers there are both beginners and developers with more than 10 years of experience.

Below we will consider 10 options for managing a family budget in 2019.

Excel spreadsheet for maintaining a family budget

Entering data into a spreadsheet is the first step from calculating in a notepad to modernizing family budgeting. IN Excel program There is ready-made templates for keeping an estimate of income and expenses, but you can download a more convenient template on the Internet or build your own table.

Advantages of an Excel spreadsheet for keeping track of family expenses

- No additional installation required software– work is carried out in a program from the standard MS Office set or free analogues;

- The ability to independently determine the components of accounting - categories of income and expenses, family members;

- All family members can use the program;

- You can store a data file on a USB drive and have access to accounting from any computer.

Disadvantages of an Excel spreadsheet for controlling family spending

- There is no special interface for the family budget - pictures for categories, options for categories of income and expenses;

- You can only work from a computer or laptop; there is no synchronization between different PCs (although you can configure it using any cloud storage if you wish).

An alternative to an Excel spreadsheet is Google Sheets

Google Sheets is part of Google service Disk. You will need to create an account once and then you can use all the features.

Advantages:

- can be used for free - this is a significant plus, because we talk about saving money in the family;

- There is synchronization via the Internet + you can install the application on your phone.

Personal Finances

The program, formerly known as Personal Finances and now called Azlex Finance, has been around since 2006 and is constantly being improved.

Advantages of Azlex Finance / Personal Finances

- Possibility of accounting by several users. Each family member can create their own personal account with their own password and the ability to hide some transactions from other family members;

- There are versions for iOS and Android with synchronization of mobile and computer versions via the Internet. You can enter information directly in the store from your phone so you don’t forget anything;

- Convenient, quick transaction entry;

- Ability to edit spending categories, family composition, contractors;

- Convenient creation of reports on spending categories, accounts, family members, the ability to view financial dynamics;

- The presence of a planner that allows you to reflect future and regular expenses in the calendar;

- Nice design with the ability to assign icons to expense categories.

Disadvantages of Azlex Finance/Personal Finances

- Not all features are available in the free version;

- The program is very detailed, which requires time to familiarize yourself with all the features.

Review of Easyfinance.ru

EasyFinance Ltd has been operating since 2009 and offers paid applications for iPhone and Android or free family budget management directly on the website. There is no version for computer available.

There are 3 tariffs with different functionality.

Advantages of easyfinance.ru

- Availability of the main functions of the budget program - reports, schedules, planning;

- The entire amount of funds for the month is shown in the form of a tachometer, where the arrow indicates the amount of money in currently. It’s convenient to monitor expenses and avoid falling into the red zone;

- Possibility of binding bank card to your account (not for all banks). When paying for goods and services with a card, the transaction will be automatically entered into the program, and you will not have to waste time entering it manually;

- The program specifically places an emphasis on long-term planning, which allows you to save about 15% of your income for major expenses and dreams;

- Availability of a calendar with reminders about the need to make regular payments;

- The program monitors the financial situation in the country and offers profitable solutions for opening deposits and loans.

Disadvantages of easyfinance.ru

- The free version only works on the website. Not everyone wants to post all the information about their income on the Internet, although the site is protected;

- Paid versions are presented in the form of various tariffs from 99 to 250 rubles per month.

- There is no multi-user interface - the program is focused on personal, not family finances.

Review of Drebedengi.ru

Another online service, operating since 2007. Represented by a computer program and mobile applications in free and paid versions.

Paid once a year at a rate of 599 rubles.

Advantages of www.drebedengi.ru

- Availability of multi-user mode;

- Availability of applications for computer, Android, iOS, Windows Phone and the ability to synchronize data across different devices;

- Availability of a planner, reports, tracking the dynamics of balances;

- Possibility of processing bank SMS by the program for automatic entry of transactions;

- Shopping list function. You can make a list in the program before going to the store. It’s convenient that different users can make a list and make purchases - a wife can make a list on a computer from home, and a husband can see it on his mobile while in a store - and there’s no need to dictate anything over the phone;

- Data backup by sending backups by email;

- Nice minimalistic design with images assigned to categories.

Disadvantages www.drebedengi.ru

- The free version has a minimum of features: no multi-user mode and synchronization, no budget planning, no report templates.

- The free version also contains advertising.

- Actually, free version allows you to only record transactions.

Mybudget.ws

A relatively young service, operating since 2013. Offers home accounting on a computer, tablet, phone through the website. There is a free trial version and two paid plans – 249 and 299 rubles per year.

Advantages of mybudget.ws

- Keeping records of several accounts: cash, cards, savings;

- Availability of synchronized computer and mobile version;

- Convenient creation of reports in the form of graphs and tables;

- Financial goal. The program helps you set goals and move towards their implementation;

- Ability to assign labels to categories.

Disadvantages of mybudget.ws

- Lack of multi-user interface;

- Poor features of the free version.

Zenmoney.ru

Zen Money is a free online service that has been operating since 2010. There is a mobile version that is sold in Google Play 590 rubles each.

Advantages of zenmoney.ru

- Multiplayer mode;

- Mobile and computer versions with synchronization;

- The mobile version has a function for recognizing bank SMS. When an SMS from the bank arrives on your smartphone, the program automatically reads the purchase information and enters the data into the desired category - no need to waste time manually entering information;

- There are many opportunities for financial analysis, there are various tables and graphs, comparison of income and expenses by period.

Disadvantages of zenmoney.ru

- There are errors with data synchronization;

- Not everyone will like the minimalist design without category labels.

Internet banking

Some banks offer financial accounting as part of the Internet Banking service.

Advantages of accounting via Internet banking

- All transactions are entered automatically when paying for the transaction by card - you do not need to create transactions yourself, nothing will be forgotten;

- The data is stored on the bank's server - it will not be lost, and you can always access it from any device.

Disadvantages of Internet banking

- It is not possible to enter expenses in cash;

- No multiplayer mode;

- Few functions for analysis and budget planning.

- In the long term, it is problematic to obtain all the cost statistics.

Rating leaders - who is the best in 2019?

Let’s summarize what program or service will be most convenient for keeping track of your family budget/personal finances.

- Personal Finances programs (1st place)

- Home economics (2nd place).

- Google Sheets (if used instead of Excel), then third place.

You also need to consider, that these assessments for some items may change over time and are subjective. If you notice an inaccuracy, you know a good program/service, then write in the comments, I will definitely add it.

It would also be interesting to know alternative options keeping family records of money. Write below in the comments.

Programs for maintaining, accounting and planning a family budget, are reliable assistants for effective management of the family budget. Why? Because they allow you to automate many processes, which greatly simplifies the process of maintaining home finance.

In addition, this software has a lot auxiliary functions, which allow us to identify weak and strengths your relationship with money will open your eyes to seemingly obvious things, but for some reason not used in everyday life. Programs for maintaining a family budget greatly facilitate and help create a holistic picture of our relationship with finances.

Purpose of the review

- Determine from variety specialized software, the best value for money;

- Select the most optimal and easy-to-use program for maintaining a family budget;

- Determine the main characteristics of the proposed programs for maintaining a family budget;

- Identify the simplest and most understandable solutions for beginners, as well as select more serious and complex products for advanced users;

- Determine the degree of convenience in working with each program;

- Select the most pleasant design and management software;

Criteria for evaluation

I will evaluate all programs for managing a family budget according to five main criteria:

- Simple and intuitive interface;

- Ease of use;

- Functionality;

- Family budget planning;

- Reports and analysis.

Why exactly according to these criteria? Because these are the cornerstones of any special software for accounting and planning a family budget. Many programs today have much more complex capabilities. But they are needed only if the utility suits the criteria listed above.

If the product is difficult to learn or difficult to use on a daily basis, then the user will not need all the bells and whistles that the developers have stuffed into their product.

What programs for managing a family budget will be reviewed?

| NAME | DEVELOPER | WEBSITE |

| Greedy | AmoSoft | http://www.amosoft.net/ |

| Home Finance | Lab-1M | http://www.lab-1m.ru/ |

| Home accounting | Keepsoft | http://www.keepsoft.ru/homebuh.htm |

| Home Economics | AMS Software | http://home-economy.ru/ |

| Family budget | Nemtsev A.S. | http://www.familybudget.ru/ |

| Money Tracker | DominSoft | http://www.dominsoft.ru/ |

| Ace Money | MechCAD | http://www.mechcad.net/index_r.shtml |

| Family 2009 | Sanuel | http://www.sanuel.com/ru/family/ |

Today, these are one of the most popular programs for maintaining a family budget on a computer. I do not take into account online services for keeping track of personal finances online. In the future, I plan to regularly monitor new products and add reviews of them to my blog.

What the review will look like

I decided not to do a general review of all the programs, since it would be too large and inconvenient to understand. Therefore, a separate report will be prepared for each program, with screenshots. In the blog, I will create a special section, which will be called “Software”. IN this section, you can see the list of reviewed programs. There will also be a link to detailed review for each product and the cost is indicated.

The final stage will be the publication of a brief report on all programs, and a table with assessments of the main parameters of the program will be posted. There will also be an overall score below, based on which you can understand which product, in my opinion, deserves the highest ratings.